How can you foster collaboration while developing digital recurring payment solutions?

Executive summary

Challenge

- To propose attractive solutions that eliminate the existing problems in management of recurring payments, while also generating additional value.

Actions

- To make this endeavour as effective as possible, we decided to develop it using the co-creation model, with eight other financial organizations.

- The solution was to be adopted by these organizations into their pre-existing e-banking platforms.

Results

- The devised Recurring Payments Management concept in the form of a mobile app not only responds to the users’ needs but also offers value for financial organizations willing to implement such a solution into their already existing platforms.

Business need

The goal of this project was propose attractive solutions that eliminate the existing problems in management of recurring payments, while also generating additional value. To make this endeavour as effective as possible, we decided to develop it using the co-creation model, with eight other financial organizations. The solution was to be adopted by these organizations into their pre-existing e-banking platforms.

Client

Visa is the world’s largest payment network, with operations in over 200 countries around the world. As the steward of the global payments ecosystem, Visa leads the industry by investing heavily in innovation, the new technologies that accelerate digital payments for commerce, and the relationships with financial institutions, merchants, technology partners, and government officials.

Innovatika as a part of Visa’s digital journey

Innovatika has been a partner of the Visa Innovation Studio for many years now. As part of this cooperation, we lead projects related to creating innovative digital solutions concepts, also financial ones. We build ideas that become an inspiration in development for the entire financial sector in Poland. The vital challenge in this project was a significant number of participating entities and unpredictability. Eight banks and acquirers, six merchants, dozens of users, and, naturally, the Innovatika team who provided the research, business analysis, product design, testing design, facilitation, strategy, and innovation competencies.

Now, add COVID-19 to the mix. The current pandemic forced us to manage this project entirely remotely. Thanks to quick adjustments, and the convenience of the Mural and Zoom, we embraced the new reality and let the diversity of perspectives, needs, and approaches drive our work. As a result, the final product has generated tremendous interest from the financial industry.

It was a project, unlike any other. This time we faced the creation of a solution supporting the megatrend called membership economy. Four groups of users, several merchants, banks, acquirers and Visa, met to co-create a vision of an innovative solution for the whole ecosystem of the membership economy.

How did we master remote development?

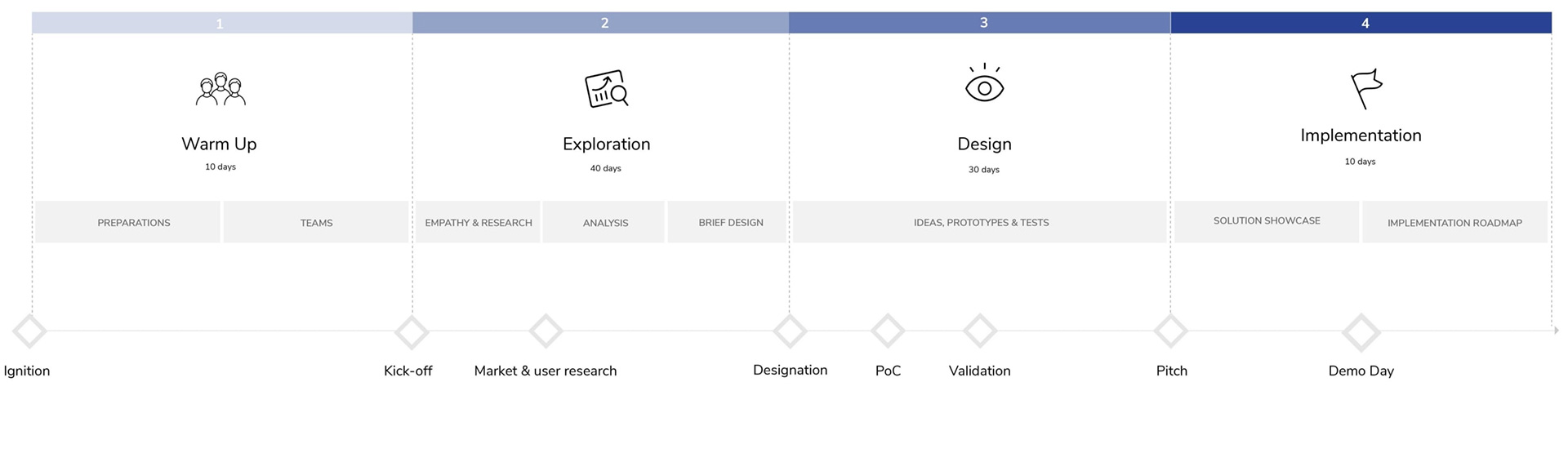

Solid framework

To ensure the speed and efficiency of a multidisciplinary team, we leveraged Design Thinking as our primary framework, along with a hybrid Lean Startup process. We did the whole process in iterations. Pivots and changes happen regularly, and coming back one or two steps in the process was not only standard but often the most desired move.

Co-creation

A team of Visa’s partner representatives from different organizations and areas undertook the challenge. Because of this, the team was interdisciplinary and well-equipped to work out transformative and innovative solutions. Firstly, each step of the process was introduced to all of Innovatika’s participants. The tasks and activities were then executed together by the participants and primarily by our experts. A lot of them have been run “in the field” with customers. Innovatika’s experts managed the team, and our experts were responsible for designing the new solution.

Testing

The secret weapon in every project is when we conduct market testing, utilizing the prototypes built in the design phase. To create a successful testing strategy, you need to estimate what kind of social proof is required, what type of verification activities are necessary, and the preparation time, execution time, and cost.

Key Feature

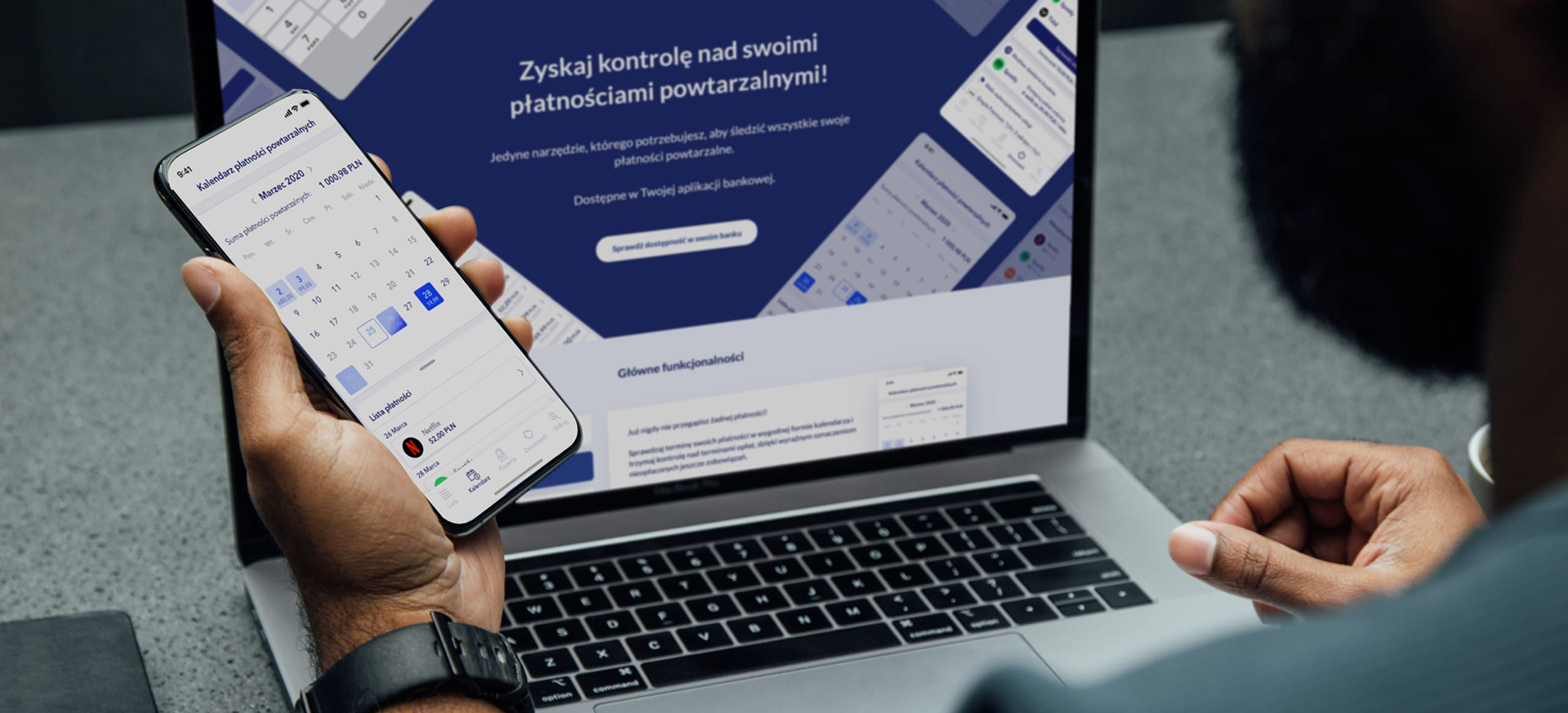

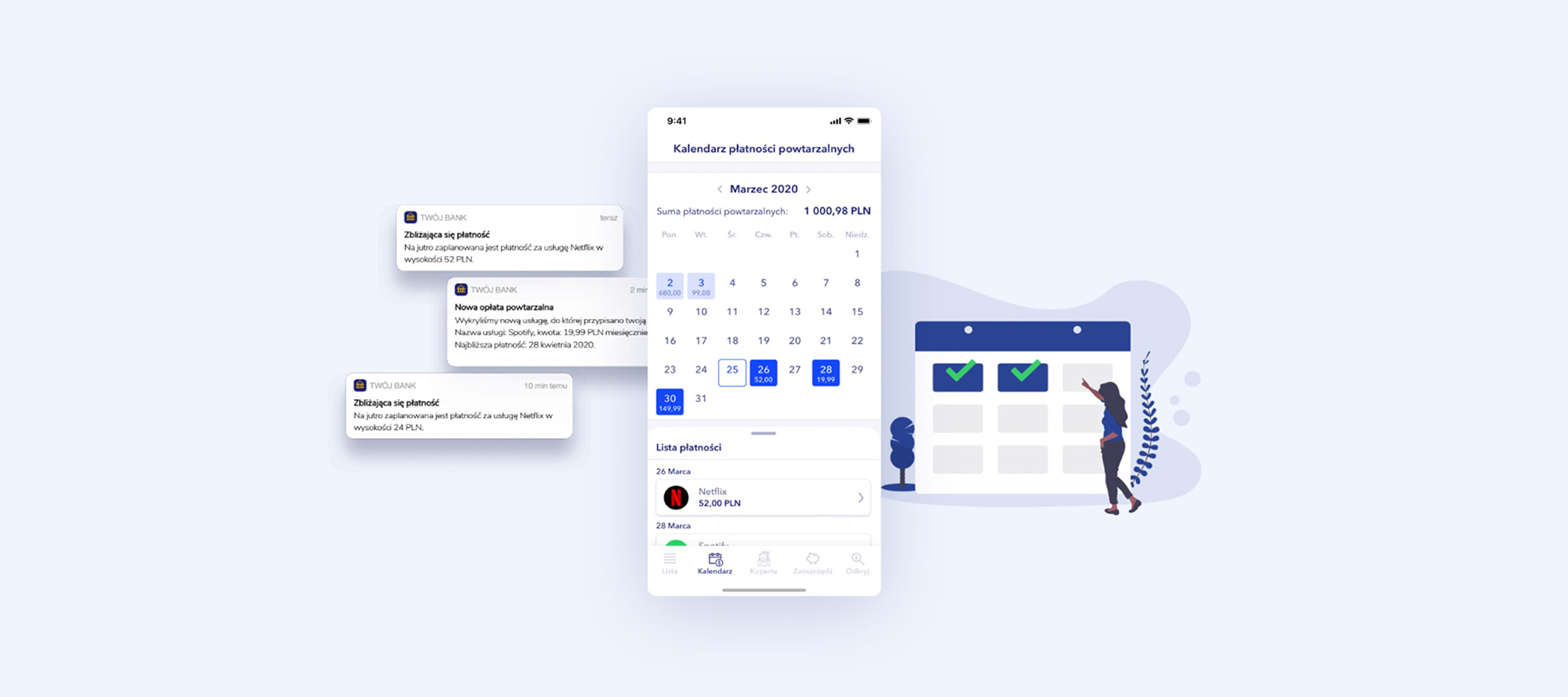

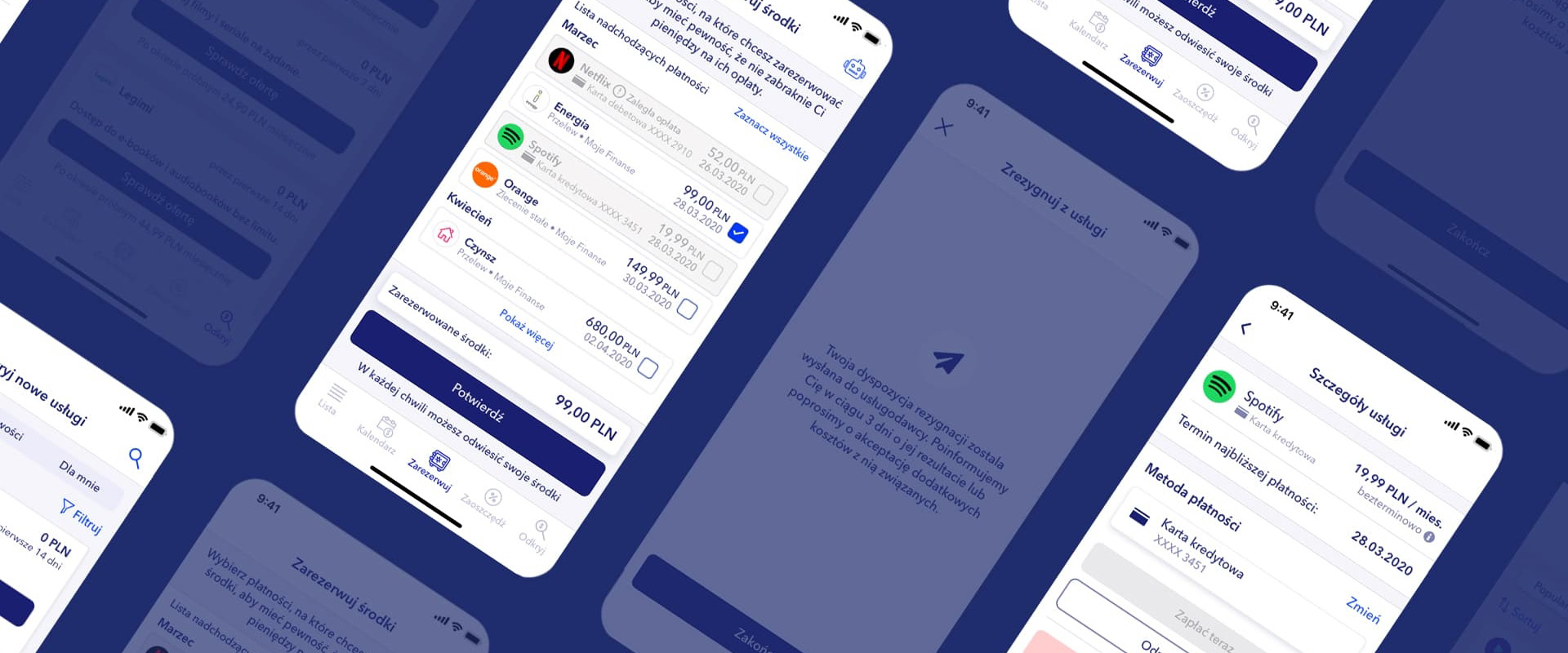

Together with Visa partners’ representatives, we have created an entirely new digital solution to manage only subscription payments. The ground-breaking part of the solution is a list of subscriptions and the ability to handle recurring payments, as well as an easily accessible process of opting out of unwanted services. Essential elements in the presentation of upcoming transactions are also the calendar view and notifications.

Opportunity to build new revenue streams

The extension of The Recurring Payments Management Toolbox solution allows banks to increase customer loyalty thanks to a more engaging mobile application. Building a transparent and unified process of resignation from services equates to a reduction in the costs of complaints. And last but not least – additional functionalities, such as recommendations for new services, give opportunities to build new revenue streams.

Better UX and Value for financial organizations

Better UX and Value for financial organizations

For the entire Innovatika team, commercialization is the holy grail. The results of our projects are supposed to bring real business value to our clients. That’s why, when building an optimal solution for this project, we continuously monitored the market to find the ideal execution time. In other words, we had to closely watch the industry to see if the currently available tools and technologies are sufficient to implement this solution.

The devised Recurring Payments Management concept in the form of a mobile app not only responds to the users’ needs but also offers value for financial organizations willing to implement such a solution into their already existing platforms.