The world is changing at an unprecedented pace, and the insurance industry is no exception. Traditional insurance companies are facing increasing competition from new insurtech startups that are using technology to disrupt the status quo. In this blog post, we will explore the innovations in the insurance industry and discuss how they are changing the game.

Welcome to “Startup of the Month by Innovatika,” our new series of articles designed to showcase the innovative edge that is shaping the future of business across the globe. Our mission? To highlight, each month, startups that are redefining industries, reinventing technology, and reshaping societal norms.

The insurance sector, with its deep roots and traditional mechanisms, has long stood as a pillar of financial security for individuals and businesses. However, in today’s fast-paced digital age, the industry is facing mounting pressures to embrace digitalization. A shift towards innovative methodologies is not just a choice, but a necessity to meet evolving customer expectations and stay competitive. The budding enterprises harness cutting-edge technologies to craft more bespoke, transparent, and efficient insurance solutions, challenging established norms and reshaping the future of insurance. The insurtech market, which shapes the future, is expected to grow rapidly in the coming years. The global insurtech market size was valued at USD 5.45 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 52.7% from 2023 to 2030 (Grand View Research, 2021).

Why innovations in insurance are important?

Innovation in the insurance sector holds more weight than ever before, given the myriad of challenges and shifts we face in today’s world. Climate change stands at the forefront of these challenges. As extreme weather events become more frequent and severe, there’s an urgent need for insurers to develop novel products that cater to these emerging risks, providing coverage for events that were once deemed outliers. By doing so, insurance providers not only protect vulnerable populations and businesses but also actively participate in global risk mitigation strategies, reinforcing their societal role.

The dynamic expectations of clients are constantly evolving. In an era of instant gratification and digital interfaces, customers seek immediate, tailored solutions. They value transparency, speed, and personalization. Innovation enables the insurance industry to be more responsive and adaptive to these demands, ensuring that policies and services align with the unique and shifting needs of every individual.

The meteoric rise of technology cannot be overlooked. From artificial intelligence to blockchain, technological evolution is redefining the possibilities within insurance. These technologies can automate complex processes, provide deeper insights into risk assessments, and offer more secure transaction methods. Embracing them is no longer optional, but a cornerstone of future success. Insurers that harness and integrate these technologies stand to gain a competitive edge, offering services that are not only efficient but also groundbreaking in their approach.

Innovators in Insurance

Laka: Collective Bike Coverage – United Kingdom

Laka is a peer-to-peer bike insurance company that revolutionizes the traditional insurance model by calculating premiums based on the actual cost of claims for that month. By reinvesting 80% of the contributions into a collective fund, Laka fosters a sense of community among cyclists, helping each other with issues like bike repairs and replacements. The remaining 20% ensures Laka’s smooth operation. This unique approach promotes accountability and responsibility while offering comprehensive coverage against theft, third-party liabilities, legal costs, and even bike rentals in times of need.

You can learn more on their website: https://laka.co.uk/

Greater Than: Predictive AI to Analyze Crash Probability and Climate Impact – Sweden

Greater Than is an innovative startup that uses artificial intelligence to predict accident probabilities and evaluate CO2 impacts in real-time. By analyzing GPS data, the company’s AI-driven model identifies the minority of drivers responsible for most crashes, allowing insurers to tailor their pricing and policies accordingly. Additionally, Greater Than’s “Climate Impact Score” quantifies a driver’s environmental impact, enabling the development of eco-friendly insurance products and encouraging responsible driving behaviors.

You can learn more on their website: https://greaterthan.eu/

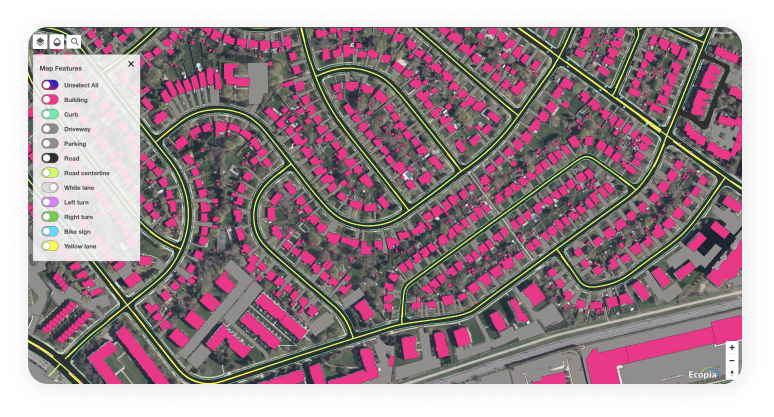

Ecopia: Digital Mapping Redefined for Insurance Precision – Canada

Ecopia utilizes advanced AI technology to transform high-resolution geospatial imagery into detailed digital maps. With the ability to generate millions of square kilometers of vector data each month, Ecopia provides unparalleled speed and accuracy when it comes to mapping our rapidly evolving physical environment. This precision mapping becomes invaluable for the insurance industry, offering unmatched property analytics and building-based geocoding accuracy. Insurers can make more accurate risk assessments, streamline underwriting processes, and manage claims with heightened precision, resulting in improved efficiency and better customer experiences.

You can learn more on their website: https://www.ecopiatech.com/

Lydia AI: AI-Driven Health Insights Influence Insurance in Asia – Canada

Lydia AI is reshaping Asia’s insurance sector with its advanced machine learning capabilities. By leveraging vast healthcare databases and consumer devices, the startup delivers precise health risk scores that benefit both individuals and insurers. Individuals gain clarity on their health standings, while insurers can tailor-fit solutions to meet diverse client needs. In addition to simplifying the insurance acquisition process and negating the need for physical medical exams, Lydia AI aims to expand insurance accessibility, particularly for individuals with chronic conditions who may face traditionally prohibitive premiums.

You can learn more on their website: https://lydia.ai/

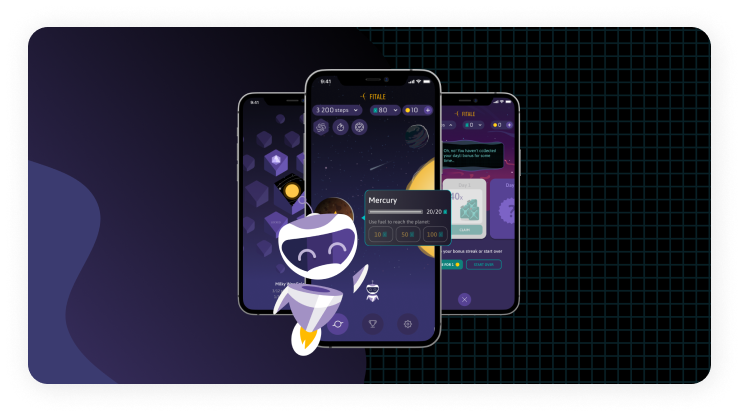

Fitale: Step Towards Tailored Insurance Rewards – Poland

Fitale is a uniquely designed app that encourages daily physical activity, specifically walking, and offers intriguing opportunities for the insurance sector. Insurers can leverage Fitale’s data to provide tailored health insurance plans or incentives for individuals who consistently meet their physical activity targets. The app transforms steps into fuel for a virtual space exploration journey, motivating users to maintain regular physical activity while setting realistic health objectives. The communal approach of Fitale, including inviting friends to promote a collective healthy lifestyle, allows insurance companies to introduce group insurance plans or team-based challenges, ultimately driving more user engagement and fostering a health-conscious community.

Fitale is a part of Innovatika’s investment portfolio. You can learn more on their website: https://www.fitale.com/

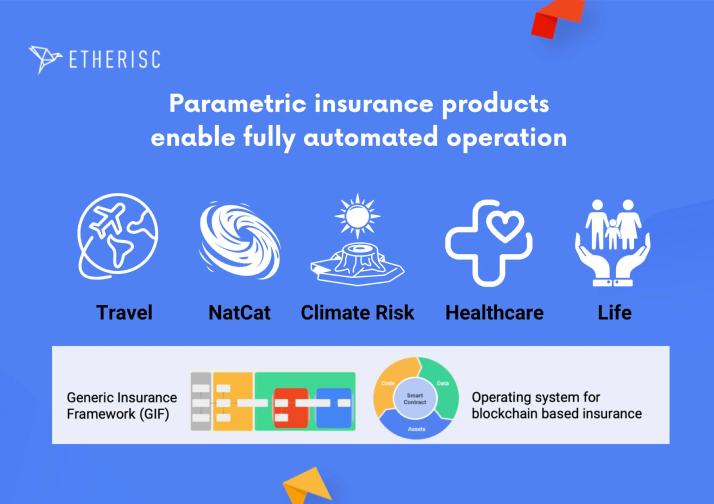

Etherisc: Decentralizing Insurance Through Blockchain Technology – Germany

Etherisc is offering a decentralized platform rooted in blockchain technology. Etherisc’s open-source platform enables both established insurers and startups to craft transparent, fair, and broadly accessible insurance products. Central to its platform is the “GIF” or “Generic Insurance Framework,” a suite of open-source smart contracts that streamline insurance product and policy lifecycle functions. This framework is especially adept at facilitating parametric insurance products, which promise deterministic payouts for predefined events. By automating and decentralizing insurance transactions, Etherisc aims to enhance transparency, efficiency, and cost-effectiveness in the insurance industry while opening up new possibilities for innovative insurance offerings.

You can learn more on their website: https://etherisc.com/

Quantee: Empowering Insurance Pricing with AI – Poland

Quantee is a software as a service (SaaS) platform catering to the needs of the property and casualty (P&C) as well as health insurance domains. With its dynamic pricing platform, insurers can enhance models’ granularity, increasing accuracy and responsiveness to market dynamics. Quantee’s flexible architecture allows for traditional and advanced machine learning techniques, making it adaptable for insurers regardless of their current technological sophistication. By streamlining pricing processes and providing real-time monitoring, Quantee helps insurers achieve improved underwriting results, higher conversion and retention rates, and overall enhanced efficiency in a rapidly evolving insurance landscape.

You can learn more on their website: https://www.quantee.ai/

Climatica: AI-Driven Parametric Insurance for Weather-Dependent Risks – Poland

Climatica is an insurtech startup that offers AI-driven parametric insurance for businesses exposed to weather-related risks. Leveraging AI algorithms and decades of meteorological data, Climatica rapidly analyzes weather phenomena to assess damages and provide prompt compensation payouts. This unique model of insurance pays out automatically when a specified external parameter, such as rainfall in a specific location, reaches a predetermined threshold defined in the policy. With the increasing unpredictability of weather patterns and the potential impact on sectors like agriculture, construction, renewable energy, real estate, and outdoor events, Climatica aims to provide a safety net that protects businesses from weather-related risks.

You can learn more on their website: https://www.climatica.ai/

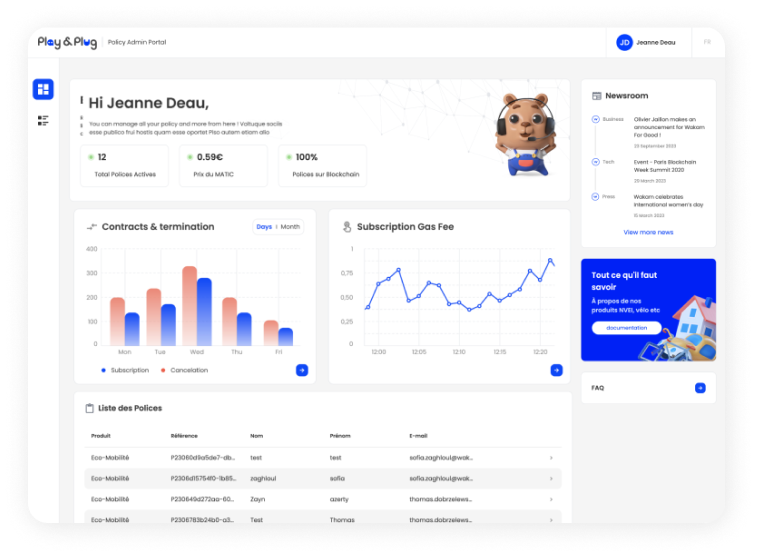

Wakam: Embedded Solutions – France

Wakam is an innovator in the insurance sector, mastering embedded insurance with a strong B2B2C approach. They provide white-label insurance services tailored for diverse partners like brokers, e-retailers, and insurtechs. Their “Plug & Play” platform streamlines the creation and management of insurance products, especially for industries aiming to integrate insurance, yet not having it as their primary offering.

Wakam is also open to create bespoke products like usage-based insurance, parametric insurance and many others. Their adaptive risk mindset allows the company to explore risks in emerging societal uses and conventional business niches. With a dedication to clarity, fairness, and inclusivity, Wakam offers plainly-worded contracts, transparent financial practices, and zero-margin products designed to serve the socially vulnerable segment of the population.

You can learn more on their website: https://wakam.com/

Our September 2023 start-up of the month:

Tractable: AI Visual Assessment Streamline Insurance Claims – United Kingdom

Tractable is a leading Applied AI startup revolutionizing the property and auto insurance sector. By leveraging advanced AI technology, Tractable provides rapid visual assessments of damage, significantly expediting the claims process from hours to minutes. With access to millions of data points and images, their AI conducts a thorough evaluation of photos, providing precise damage estimates accompanied by a certainty score. This innovation not only accelerates payouts for clients but also promotes sustainability by helping repair shops identify salvageable parts. With Tractable, the insurance and repair industry becomes faster, smarter, and more eco-friendly.

You can learn more on their website: https://tractable.ai/

Is your start-up our next winner?

Eager to be recognized for your exceptional achievements? Obtain an exclusive badge from Innovatika by emailing us at: welcome@innovatika.com.

Share your accomplishments and contributions, and our team will proudly present you with a personalized badge. Highlight your commitment to innovation, and let the world acknowledge your exceptional expertise with an Innovatika badge. You also get a chance to get featured in one of the next editions of Startup of the Month series.