Is banking and finance really as boring a sector as many think? Oh no! Quite the opposite. It is an area that influences our everyday life. Every day new financial products appear in it, as well as a multitude of added services (VAS). Thanks to it, we achieve our goals – we run a business, invest in the future, or carry out daily tasks.

Innovation – the heartbeat of the finance industry

In the world of banking and finance, the only constant is change. Since the financial crisis of 2008, through the development of mobile internet, to AI, the financial sector has been continually trying to evolve. This evolution places traditional institutions, with their centuries-old practices, under significant pressure from fintech companies. These innovative startups are challenging the status quo of financial services, redefining what traditional banks have offered for years.

Leveraging the latest in technology, fintechs are crafting offerings tailored to customer segments that were once broadly categorized as the ‘mass market’ by conventional banks. They provide targeted and sophisticated solutions, with artificial intelligence playing a key role in developing responses to the unique needs and expectations of individual users.

Startups are revolutionizing the market with their solutions, aligning with the expectations of today’s digital consumers and elevating service quality standards. Traditional banks are responding to this shift, undergoing transformative changes at an unprecedented rate. This evolution is unfolding to the advantage of us, the customers.

Innovators in the market

Welcome to “Startup of the Month by Innovatika”, our new series of articles designed to showcase the innovative edge that is shaping the future of business across the globe. Our mission? To highlight, each month, startups that are redefining industries, reinventing technology, and reshaping societal norms.

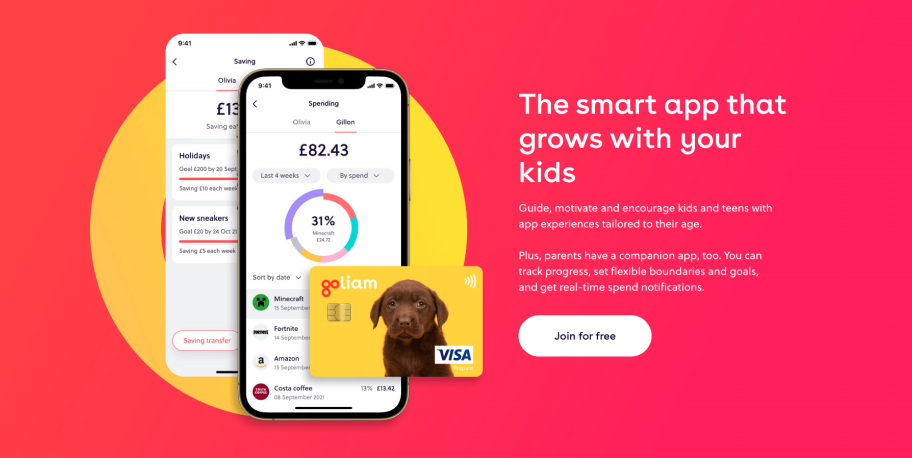

GoHenry: Financial Education for the Young – UK

GoHenry stands out in the fintech world with its focus on the youngest generation. What sets GoHenry apart is its financial management app designed specifically for children, teenagers, and their parents, coupled with personalized payment cards. Through the app, parents can monitor spending, set limits, and control where the card is used by blocking certain merchants or ATM withdrawals. They can also create tasks for which their children can earn money. This approach enables young users to learn money management, saving, and financial responsibility in a way that is both safe and appealing to them. Additionally, GoHenry offers educational and interactive tools that assist youngsters in better understanding the value of money and the financial consequences of their decisions.

Learn more on their website: https://www.gohenry.com/

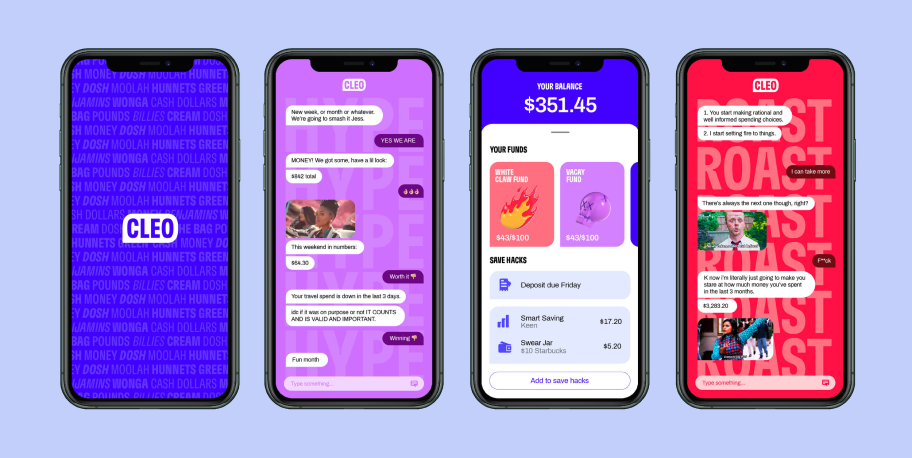

Cleo: Creative AI Assistant – UK

Cleo is an AI-powered financial app tailored for millennials. Users grant Cleo access to their spending data to assist in savings. Its unique feature is the playful, humorous interaction with users, including “roasting” or hyping spending behaviors using memes and GIFs. The app offers a range of educational and budgeting tools, including a “swear jar” feature that penalizes unwanted spending, helping users curb their habits. Additionally, Cleo offers a credit card to aid in building credit history. Combining financial education, interactive tools, and credit-building opportunities, Cleo is a unique, user-friendly resource for young people managing their finances.

Learn more at: https://web.meetcleo.com/

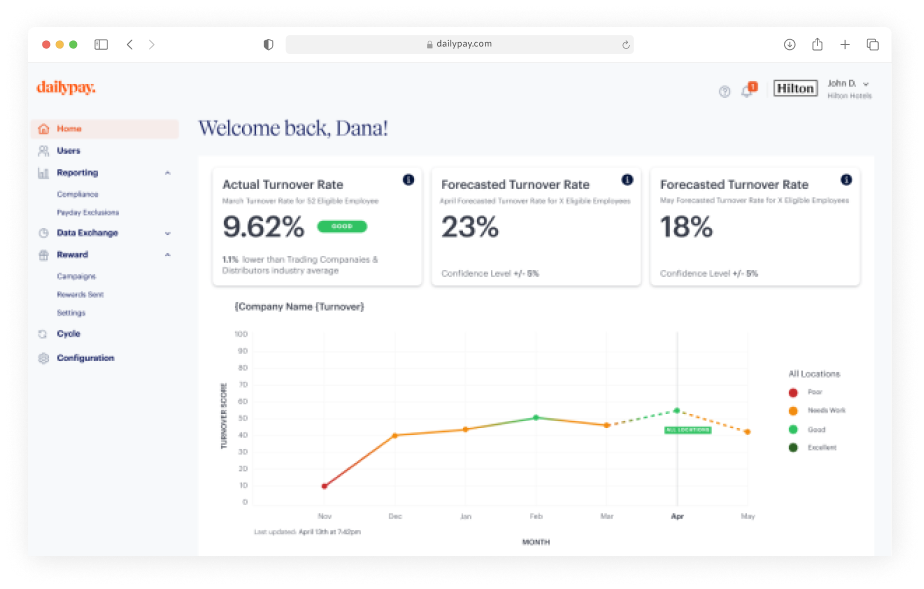

DailyPay: Daily Wage Payments – USA

DailyPay allows access to earned wages before payday, offering flexibility and greater financial control. The DailyPay platform, available as a mobile app, provides real-time insights into earnings and the option for early payments. It integrates seamlessly with existing payroll and time management systems, avoiding changes in existing payout processes. DailyPay’s innovative and flexible solution enhances employee satisfaction and loyalty while reducing turnover.

Learn more on their website: https://www.dailypay.com/

Silent Eight: Combating Financial Crimes – Poland

Silent Eight leverages artificial intelligence to assist financial institutions in fighting money laundering and terrorist financing. Its technology analyzes vast data, including sanction lists, criminal records, court files, and other sources to identify risky transactions and individuals. Silent Eight offers cloud-based, customizable solutions that reduce false positives and allow analysts to focus on complex cases. With increased detection accuracy and minimized error risk, Silent Eight plays a crucial role in global financial security.

Learn more on their website: https://silenteight.com/

Cadence Cash: Supporting Minorities – USA

Cadence Cash, a non-profit fund, is committed to financial inclusivity and economic support for small businesses led by women and minorities. It offers financial products like microloans, contract financing, invoice financing, and revenue-based credit lines. Additionally, the organization provides grants to support business growth and expansion. Cadence Cash not only offers financial assistance but also coaching, support, and access to a business network, crucial for small business success. They focus on equal access to financing and supporting entrepreneurship in underrepresented communities.

Learn more on their website: https://cadencecash.com/

Tink: Open Banking Solutions – Sweden

Tink enables banks, fintechs, and other companies to access financial data from various institutions while maintaining high standards of security and privacy. Specializing in data aggregation, payment initiation, and financial data analysis, Tink’s platform allows the creation of personalized and efficient financial services. Its contributions foster a transparent and innovative banking ecosystem.

Learn more on their website: https://tink.com/

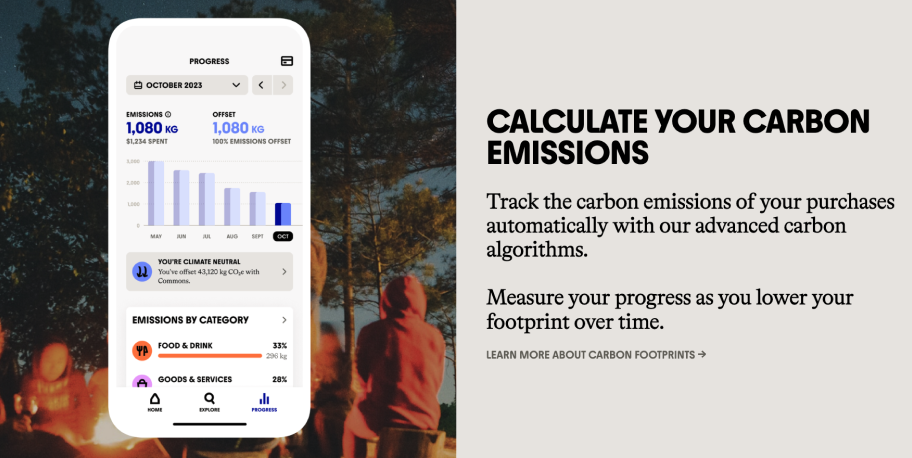

The Commons: Eco-Friendly Lifestyle Support – USA

The Commons is a mobile app that promotes an eco-friendly lifestyle. Users connect their bank accounts to the app, which calculates carbon emissions based on purchases and expenses. The app provides personalized tips for reducing carbon footprints and making more sustainable purchasing decisions. Users can offset emissions by supporting verified climate projects. In 2022, The Commons users reduced their carbon footprint by 20% on average and saved about $200 monthly. The app effectively raises ecological awareness and assists in making better choices.

Learn more on their website: https://www.thecommons.earth/

Our start-up of the month – January 2024:

Charlie: Banking Services for 62+ – USA

Fintech Charlie focuses on individuals over 62 years old, creating unique solutions tailored to their needs. Users benefit from a range of fraud prevention services. The Charlie card features a ‘Sleep Mode’ to prevent unauthorized transactions when inactive. Online transactions can be blocked or limited to selected stores. Customers can add a trusted family member to receive important account alerts without accessing details. Charlie also helps verify suspicious emails for its clients. When the Charlie team calls a client, the app notifies them. Amid rapidly changing technology, the senior segment often gets overlooked. Charlie changes this, prioritizing safety and customizing products for their unique needs.

Learn more on their website: https://www.charlie.com/

Is your start-up our next winner?

Eager to be recognized for your exceptional achievements? Obtain an exclusive badge from Innovatika by emailing us at: welcome@innovatika.com.

Share your accomplishments and contributions, and our team will proudly present you with a personalized badge. Highlight your commitment to innovation, and let the world acknowledge your exceptional expertise with an Innovatika badge. You also get a chance to get featured in one of the next editions of Startup of the Month series.